Triple Entry Accounting

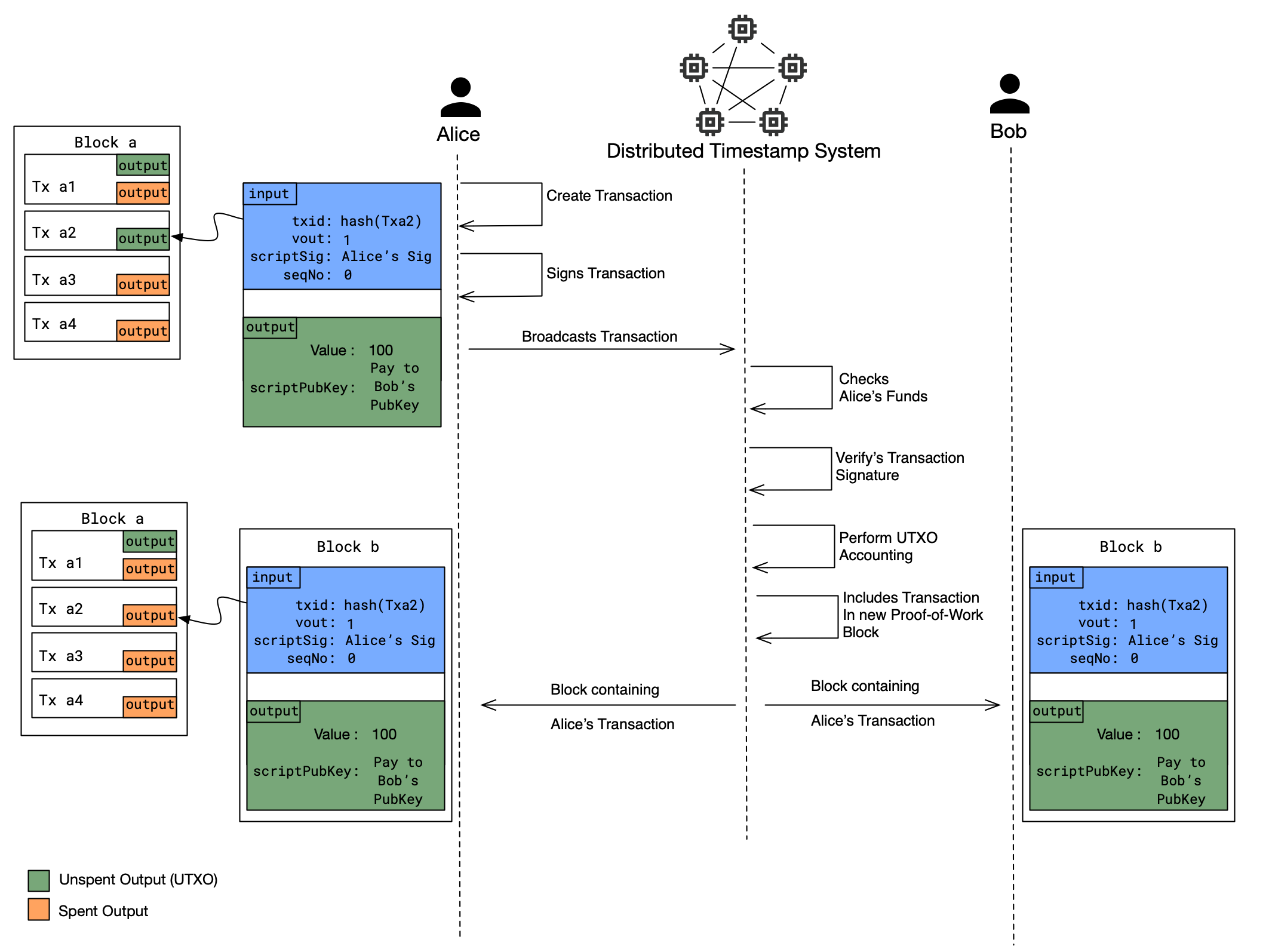

Let’s take a fresh look at the idea of A Triple-Entry Accounting System. See Figure 1.

Figure 1: Bitcoin Triple Entry Accounting

Figure 1 represents the lifecycle of a Bitcoin Transaction. It is deliberately drawn to reflect the process depicted in our Three Party Payment System.

Note that with the Trusted Issuer removed from the process, we no longer have a second Signature over Alice’s transaction. However, let’s consider what the purpose of the Trusted Issuer’s Signature was to begin with; as a trusted third party, the Issuer was responsible for maintaining an internal set of account balances on behalf of Alice and Bob. The Issuer, by signing Alice’s transaction, in effect joined into a legal agreement by attesting a truth on Alice’s behalf. It is this legal liability which underpins the trust that Alice and Bob places in their Issuer.

Within Bitcoin, the individual Transaction Processor (A node within the Distributed Timestamp System) still acts as an Issuer. However in the absence of a digital signature provided by the Transaction Processor, they are no longer a legal party to the agreement between Alice and Bob. In this case it is the financial liability of having their expended Proof-of-Work rejected by the other Transaction Processors in the network which acts to keep the individual Transaction Processor honest. Alice and Bob are in effect trusting that a Transaction Processor (A) will not act against their own economic interest, and in the event that they do, another Transaction Processor (B) will step up and secure Alice and Bob’s transaction instead. It is upon this Economic Security Model that Alice and Bob’s trust in the Distributed Timestamp System rests.

With Bitcoin, our Distributed Timestamp System now secures user balances by engaging in the competitive endeavour of Transaction Processing (proof-of-work mining), part of which is the need to give an honest account of transaction validity. In this case, the Transaction Processor has to :

- Attest that Alice has the necessary funds to spend ( validating Transaction Inputs against a UTXO set).

- Verify that Alice has generated a valid, signed Transaction according to a universal set of protocol rules.

- Perform UTXO accounting on behalf of Alice and Bob (removing UTXO coins that Alice spent, adding UTXO coins created by Alice’s transaction).

- Create an immutable public record of the transaction and claim payment for their service.

Remember that Triple-Entry Accounting is the means by which we get a digital cash system. Let’s validate that our system still qualifies as a Triple-Entry Accounting system:

- The Trusted Issuer has been replaced by a Distributed Timestamp System

- We have replaced our Signed Receipt with a Signed Transaction

- While our Signed Transaction no longer contains the signature of a Trusted Issuer, it has been immutably bound into a signature-chain guarded against modification by the economic incentive structure within the Distributed Timestamp System.

- All three parties (Alice, Bob and the Distributed Timestamp System) have copies of the Signed Transaction.

Success ! We have preserved our Triple-Entry Accounting System, and with that we now have Bitcoin: A Peer-to-Peer Electronic Cash System